nebraska sales tax rate on vehicles

This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. Counties can also add a 05 option sales tax but that.

Sales Taxes In The United States Wikiwand

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. How Does Sales Tax Apply to Vehicle Sales. Vehicles are considered by the IRS as a good that can be purchased sold and traded.

The Nebraska state sales and use tax rate is 55. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car.

With local taxes the total sales tax rate is between 5500 and 8000. Subsequent brackets increase the tax 10 to. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human. The sales tax on motor vehicles attributable to a five percent state sales tax rate is deposited in the Highway Trust Fund and expended to build repair or maintain state or local roads and. 31 rows The state sales tax rate in Nebraska is 5500.

You can find these fees further down on the page. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. 536 rows Nebraska Sales Tax55.

With local taxes the total sales tax rate is. Additional fees collected and their distribution for every motor vehicle registration issued are. Counties and cities in Nebraska are allowed to charge an additional local sales tax on.

There are no changes to local sales and use tax rates that are effective January 1 2022. There are a total of 334 local tax. The state sales tax rate in Nebraska is 55 and cities are permitted to add a local sales tax at rates of 05 1 15 175 or 2.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. There are no changes to local sales and use tax rates that are effective July 1 2022.

This is less than 1 of the value of the motor vehicle. The Nebraska state sales and use tax rate is 55 055.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

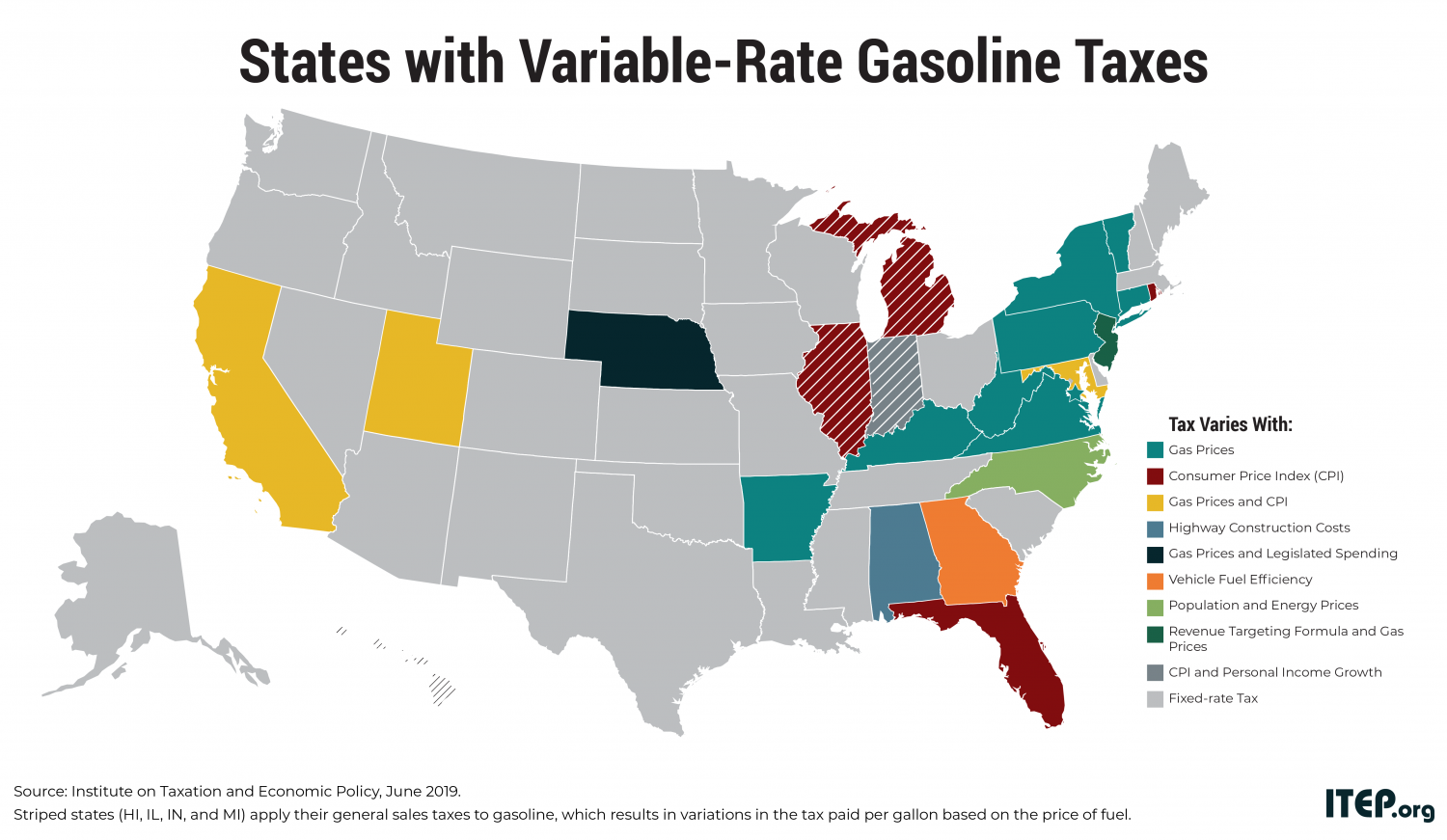

Most Americans Live In States With Variable Rate Gas Taxes Itep

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Sales Tax On Cars And Vehicles In Nebraska

What S The Car Sales Tax In Each State Find The Best Car Price

Nebraska Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Vehicle Sales Tax Deduction H R Block

Understanding California S Sales Tax